what is bear trap in investing

It is the opposite of a bull market which is a period of consistently rising stock prices. If you invest your money at these kinds of returns and simultaneously pay 16 18 or greater APRs to your creditors youre putting yourself in a position to lose money over the long term.

Ad New And Experienced Investors Should Consider These Top-Recommended Brokerages.

. The assets price quickly recoups the losses suffered in the short-term dip defying trader expectations. While short selling during a bear trap is a viable strategy all short positions shall be perfectly timed. Investors who have bet against the market or individual security are called bears.

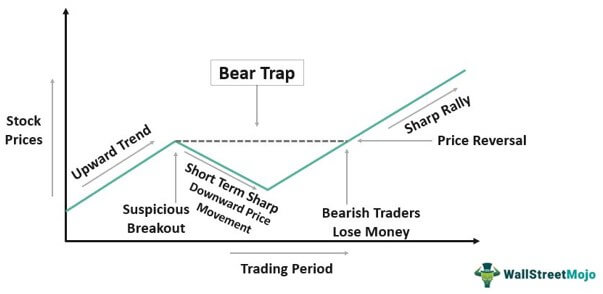

Ad Learn What You Want When You Want. 12 hours agoApple has decades of experience innovating in consumer technology. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

Related

Dont take a short position. Selling a stock short is highly speculative and high-risk. Its a trap since it encourages trend.

The service is tailored for asset managers hedge funds financial advisors traders and more. A bear trap is usually created by institutional investors or big traders to set up retail or naive traders to take short positions. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

A bear trap is the opposite of a bull trap. A bear trap is an investing pattern that happens when a falling security reverses course and begins rising again temporarily or permanently. A bear trap happens when a trader buys assets expecting the price to rise but the price instead falls.

In general a bear trap is a technical trading pattern. It still isnt cheap Parkev Tatevosian. Futures stocks bonds currencies and cryptocurrencies.

This causes traders to open short positions with expectations of profiting from the assets price decline. Each type of investment has its own level of threat. It is a false indication of a reversal from an uptrend into a downtrend.

Its a technical pattern where the price dips or starts falling then quickly reverses upwards. Even though the price action that precedes the actual bear trap can last for months the trap itself often. A bear trap in financial markets refers to a period of time when a particular instrument breaks through a key support level and then reverses thus recovering lost positions.

The assets bought become worth less than the purchase price leading to a loss. Open an Account Now. Use a different trading strategy.

What is a Bear Trap. What is a bear trap. The Bear Traps report is a weekly independent Investment Research Publication focusing on global political and systemic risk with actionable trade ideas.

In the context of cryptocurrency a bear trap could occur when investors believe prices are about to rebound. After a while it swiftly reverts to resume its upwards movement. A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside.

A break through a support level can be just as sharp as a reversal. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Investors and traders take short positions thinking that the rally is over.

The simplest way to avoid getting caught in a bear trap is to avoid taking short positions altogether. To put it simply a bear trap is a fake price drop often orchestrated by a few or more traders to trick other market participants mainly novice investors into selling a particular asset. However instead of continuing to fall the stock reverses and moves past its prior high.

When investing in marketplaces that handle with types of investments like stocks commodity securities or even cryptocurrency new traders are often caught off guard by price volatility. As a difficult proposition for novice traders a bear trap can be recognized by using charting tools available on most trading platforms and demands caution to be exercised. That said the company faces powerful headwinds in the near term.

It makes this trading type extremely complicated. Heres a closer look at bear trap trading. Shopify is an excellent business with nearly a decade of spectacular growth.

0 What Is A Bear Trap In Investing. To put it simply bear traps are fake signals for the upward trend changing to a downward trend. A bear trap is common when trading various assets such as stocks currencies and commodities.

A bear trap is best-defined as a false reversal at the culmination of a pattern. Learn More About American Funds Objective-Based Approach to Investing. A bear trap is a kind of synchronized but regulated selling used to induce a brief decline in the price of an asset as a precursor to a short-squeeze.

5 hours agoBear case. A bear trap is a condition with a false signal indicating a strong downtrend momentum when the prices fall steeply but immediately rise with high buying pressure. This technical pattern can happen in all kinds of markets.

In most cases. What is a Bear Trap. Your threat tolerance Not all financial investments are successful.

It is difficult to identify a bear trap. It is called this way because it traps bears traders who are looking to benefit from a price dropdownward trend. A bear market is defined as a period in which the major stock indexeslike the SP 500 I ndex and Dow Jones Industrial Average or the Dowdrop by 20 percent or more from a recent high point and remain that low for at least two months.

Its an advanced trading strategy and isnt appropriate for most investors. Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages. Earn up to 245 APR.

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend. However a situation may arise in the market when the asset remains below support for some time luring traders into a bear. Bear traps typically follow bullish patterns.

Microsoft is a cloud software leader thats positioned for long-term success. A bear trap can be a form of coordinated and controlled selling of an asset to create a temporary downtrend in its price involving several traders who have significant holdings of a cryptoasset colluding to sell large portions of cryptocurrency at the same time. Whether youre a pattern trader or just have a hunch about the trajectory of a stock price its important to understand what a bear trap is as well as how to identify and avoid one.

What Is A Bear Trap In Investing. Motley Fool Issues Rare All In Buy Alert. A bear trap involves the price going in the opposite direction to a bullish trend.

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Meaning What It Is And How Do Bear Traps Work

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bear Trap In Stock Market Trading Quora

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

The Bear Trap Everything You Ve Ever Wanted To Know About It

What Is A Bear Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bull Trap In Trading And How To Avoid It

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Stock Trading Definition Example How It Works